Whisky Outperforms Traditional Markets

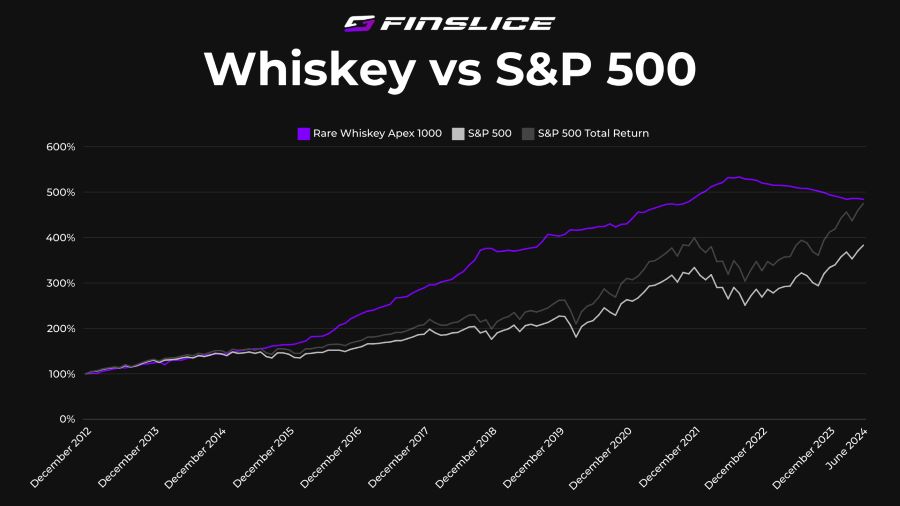

Rare whisky has emerged as a top-performing investment over the last decade, consistently delivering impressive returns. The Rare Whisky Apex 1000 Index, which tracks the value of 1,000 of the world’s most sought-after whisky bottles, has outperformed even some of the largest stock market indices, making it an attractive option for investors looking to diversify into alternative assets.

A Comparison of Performance

Between December 2012 and June 2024, the Rare Whisky Apex 1000 Index rose by 384%, significantly outpacing both the S&P 500 (which grew by 283%) and the S&P 500 Total Return (which increased by 375%). This demonstrates that rare whisky has not only kept pace with but consistently outperformed traditional equities over the long term.

The Apex 1000’s sustained growth highlights rare whisky’s resilience and strong appeal, even in the face of market volatility. While the S&P 500 benefited from dividend reinvestment, the Apex 1000 still managed to outperform it, showing the powerful return potential of collectible assets.

What Drives Whisky’s Value?

The Rare Whisky Apex 1000 Index reflects the dynamic nature of the whisky market. The bottles in the index are not fixed; they are regularly adjusted based on value changes. Bottles that appreciate significantly in price may be added to the index, while those that lose value can be removed. This fluidity helps ensure that the index remains a reliable indicator of the rare whisky market’s performance.

Additionally, the index reveals trends in whisky brands, showing which are becoming more prominent and which are losing favor among collectors and investors. Brands such as Macallan, Glenfiddich, and Ardbeg often feature prominently, while lesser-known distilleries occasionally rise due to limited releases or increased demand.

How Does Whisky Compare to Other Tangible Assets?

In our previous blog post on the Liv-ex Fine Wine 1000 Index, we discussed how fine wine has been a stable alternative investment for years. Whisky shares many of the same characteristics as wine—scarcity, emotional connection, and a growing market—but whisky’s performance has been even more explosive. The Apex 1000’s 384% growth over 12 years underscores whisky’s unique value proposition as an investment vehicle.

Why Invest in Rare Whisky with Finslice?

At Finslice, we believe that alternative assets like rare whisky should be accessible to all investors, not just the wealthy. Through our platform, you can invest fractionally in bundles of whisky bottles. This lowers the barriers to entry and provides you with an easy, cost-effective way to diversify your portfolio.

By investing through Finslice, you can own a portion of highly coveted whisky bottles, helping you take advantage of the rare whisky market’s potential for substantial returns, while reducing risk by spreading your investment across multiple assets.